Cunny Man die,cunny man bury am...Please read this

Taiwo Oyedele (@taiwooyedele) tweeted about the photo: "Effective from today, you will pay a huge fine for cash deposit or withdrawal above N500k individual or N3m corporate in (Lagos), Abia, Abuja, Anambra, Kano... Ogun (and) Rivers State. Rest of the country will take effect from 31 March 2020."

Charges could go as high as a few hundreds of thousands of naira in some cases.

Now, I understand, this has a number of people, especially proprietors of MSMEs, which handle a lot of cash concerned. I also know the notice appears to be uncomfortably short for a lot of people, so here are a few thoughts on how to avoid the charges.

As an individual in Lagos or elsewhere, from today, limit your lodgements/withdrawals into/from any single bank account to N500k. If you have to pay or withdraw more than N500k at once, use different accounts & ensure that the amount stays within the N500k threshold.

In cases of withdrawals, if the bulk sum is in one bank account, then transfer some of it to an(other) bank account(s), to ensure the amount you would have to withdraw from each bank account does not exceed N500k.

For deposits, don't deposit more than N500k into one bank account at once - you can pay into several bank accounts and then transfer all into one bank account (if you must) using your mobile app or via internet banking.

If you have only one bank account nko? E mean sey you go dey pay the money into your bank account small small every day be dat.

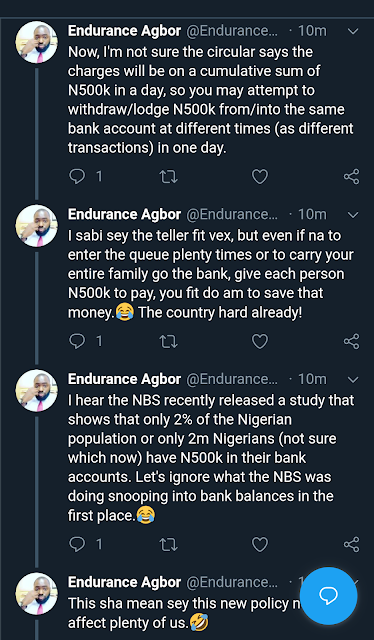

Now, I'm not sure the circular says the charges will be on a cumulative sum of N500k in a day, so you may attempt to withdraw/lodge N500k from/into the same bank account at different times (as different transactions) in one day.

I sabi sey the teller fit vex, but even if na to enter the queue plenty times or to carry your entire family go the bank, give each person N500k to pay, you fit do am to save that money.

I hear the NBS recently released a study that shows that only 2% of the Nigerian population or only 2m Nigerians (not sure which now) have N500k in their bank accounts. Let's ignore what the NBS was doing snooping into our bank balances in the first place.

This sha mean sey this new policy no go affect plenty of us.🤣

If you run an MSME or a large organisation which typically handles a lot of cash, you can also use the tips above, but ensure the sum stays within the N3m threshold.

In all, the best way to totally avoid the charges will be to let clients pay you via bank transfers and POS machines. Also, use bank transfers to pay for your services as opposed to moving large sums of money.

PS: No be legal advice be this o.🤣

You can follow me on Twitter @Endurance_Agbor

Yes na real cunny man die oooo

ReplyDeleteNa wa!

ReplyDeleteInstead of depositing 500k you pay in 490k and go back to pay in the 10k.

ReplyDeleteAbi,Smurf. Exactly what I thought yesterday. Simple.

DeleteLol as in eeehnn!

DeleteOr even 499 and go back and pay 1k. Make e pain them 😂 😂 😂😂

DeleteLol,na so

DeleteMy thoughts!😀

ReplyDeleteNigerians must always find a way

ReplyDeleteBABSY

Evil levy

ReplyDeleteIn Nigeria,there is always a way to go about situation like this,them feel say them sharp

ReplyDeleteNa so me and my cousin go first bank,dem tell us like that. Shaparly,he transferred 500k to my account and I withdrew cash then he did same in his. We carry money go

ReplyDeleteIt’s senseless! Why can’t people just embrace online banking/ transfers in the course of doing business. I never had any reason to move a lot of cash around since 2016. Even the POS can do a lot. Moving cash is pointless except for the owambe people..

ReplyDeleteGod will bless u sir for this ooo.

ReplyDeleteWhat a relief!

Endurance Agbor, Ex Malabite/law student of class 2016 UNICAL....such a hunk

ReplyDeleteWe nigerians are really funny. Why withdrawing 500,000 naira in cash, when you can simply do transfer via mobile phone. If carry of cash is reduce, a lot of robbery and other vices will also reduce drastically. We need to adjust to change and stop complaining.

ReplyDeleteI noticed that most Nigerians who complain about this policy don't even have the capacity to withdraw or deposit such amount of monies. They rant about everything for the sake of ranting. The primary reason for this policy is to curb money laundry and other illegal dealings. I for one hate going to the bank, been to the bank just once this year. Been doing cashless transactions for years its better for me cause I always have evidence of my dealings.

ReplyDeleteSugercane, and you think those money launders would care about this charges when the money is ill gotten? las las it is the masses that will be affected the most.

DeleteLmao! Let’s go and buy KOLO!

ReplyDeletethere must be a way out of anything situation.

ReplyDeleteCorrupt mentality.. just abide by the new rules, simple.. Must we devise a way out for every thing?..

ReplyDeleteThis one sweet me far!

ReplyDeleteCBN ndi ara ...as country had like they still dae look for how to be collecting peoples money in the name of charge.. thank God I read this .. instead of them to collect my money for charge I will go bank 10times a day

ReplyDeleteAll are means this government wants to use in blindfolding and defrauding the mercies by scaring is away from Bank. We are all here commenting and blabbing instead of standing to revoke against their useless policies. That's why you all are classified as lazy youths.

ReplyDelete